Empower Your Business: Bagley Risk Management Insights

Exactly How Livestock Risk Defense (LRP) Insurance Coverage Can Safeguard Your Animals Financial Investment

In the world of livestock financial investments, mitigating dangers is critical to making sure economic security and growth. Animals Risk Defense (LRP) insurance stands as a trustworthy guard against the unpredictable nature of the market, using a calculated method to safeguarding your possessions. By diving into the ins and outs of LRP insurance coverage and its complex benefits, livestock manufacturers can fortify their financial investments with a layer of safety and security that transcends market fluctuations. As we explore the realm of LRP insurance coverage, its duty in protecting livestock investments ends up being significantly apparent, guaranteeing a path towards lasting monetary resilience in a volatile industry.

Recognizing Animals Risk Protection (LRP) Insurance Policy

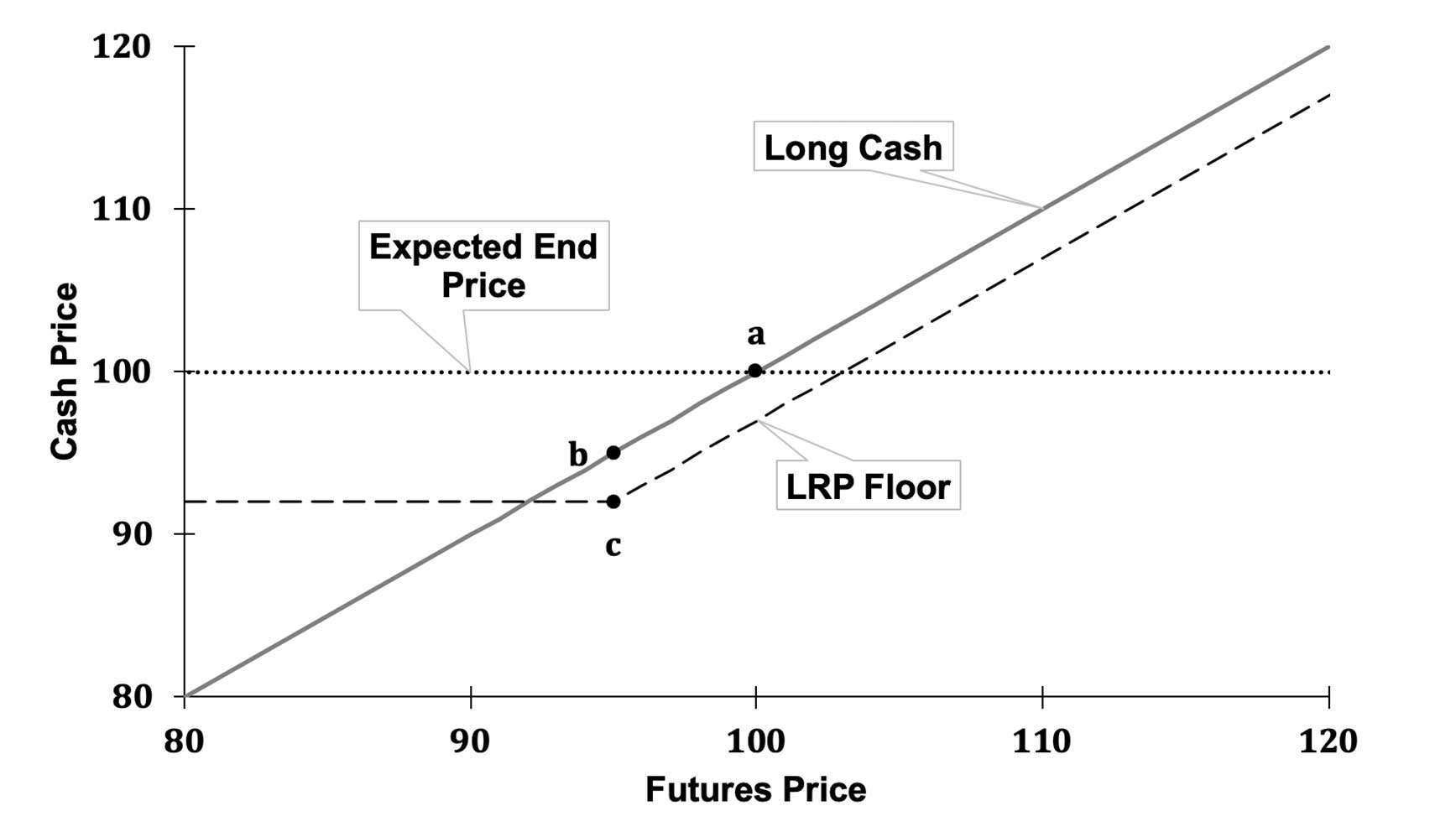

Comprehending Animals Risk Security (LRP) Insurance coverage is necessary for livestock producers wanting to reduce financial threats related to cost fluctuations. LRP is a federally subsidized insurance item made to secure manufacturers against a decrease in market value. By providing coverage for market price decreases, LRP helps manufacturers lock in a flooring price for their livestock, ensuring a minimum level of profits regardless of market fluctuations.

One trick facet of LRP is its versatility, allowing producers to personalize insurance coverage degrees and plan sizes to suit their specific needs. Manufacturers can choose the variety of head, weight array, protection cost, and protection period that straighten with their manufacturing objectives and run the risk of tolerance. Understanding these adjustable choices is vital for manufacturers to effectively manage their rate danger exposure.

Moreover, LRP is readily available for various livestock types, consisting of cattle, swine, and lamb, making it a functional threat management tool for animals manufacturers across different industries. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, manufacturers can make enlightened decisions to protect their investments and ensure economic security when faced with market unpredictabilities

Advantages of LRP Insurance Coverage for Livestock Producers

Livestock manufacturers leveraging Livestock Threat Defense (LRP) Insurance policy gain a tactical advantage in securing their financial investments from price volatility and safeguarding a secure financial ground in the middle of market uncertainties. By setting a flooring on the cost of their livestock, manufacturers can reduce the risk of substantial monetary losses in the event of market slumps.

Furthermore, LRP Insurance policy provides producers with assurance. Knowing that their investments are secured versus unexpected market modifications permits producers to focus on other elements of their organization, such as improving animal health and wellness and well-being or optimizing production processes. This tranquility of mind can lead to enhanced efficiency and productivity in the future, as manufacturers can run with more confidence and stability. Generally, the advantages of LRP Insurance policy for animals manufacturers are substantial, providing a beneficial tool for managing danger and making sure economic security in an unpredictable market atmosphere.

Exactly How LRP Insurance Mitigates Market Risks

Reducing market dangers, Livestock Risk Defense (LRP) Insurance gives animals producers with a reliable shield against price volatility and monetary unpredictabilities. By supplying security versus unexpected rate decreases, LRP Insurance coverage helps producers protect their investments and keep economic security despite market changes. This sort of insurance enables animals producers to secure in a rate for their animals at the beginning of the plan duration, ensuring a minimal price degree regardless of market adjustments.

Actions to Secure Your Animals Investment With LRP

In the world of farming threat monitoring, applying Animals Risk Security (LRP) Insurance involves a calculated process to guard investments versus market changes and uncertainties. To protect your livestock financial investment successfully with LRP, the first action is to evaluate the certain threats your operation deals with, such as rate volatility or unforeseen climate occasions. Next, it is essential to study and choose a credible insurance coverage carrier that supplies LRP policies customized to your animals and organization requirements.

Long-Term Financial Safety With LRP Insurance Policy

Making sure enduring economic security through the utilization of Livestock Threat Defense (LRP) Insurance policy is a sensible long-term technique for agricultural manufacturers. By incorporating LRP Insurance policy into their threat management plans, farmers can guard their livestock investments against unforeseen market fluctuations and damaging occasions view publisher site that can endanger their economic health with time.

One secret advantage of LRP Insurance for lasting monetary protection is the comfort it provides. With a trustworthy insurance plan in location, farmers can minimize the monetary risks related to volatile market problems and unanticipated losses due to factors such as condition break outs or natural disasters - Bagley Risk Management. This stability enables producers to concentrate on the day-to-day operations of their animals service without continuous stress over potential economic troubles

In Addition, LRP Insurance supplies a structured strategy to managing risk over the long-term. By establishing certain protection levels and choosing suitable recommendation periods, farmers can customize their insurance policy intends to align with their monetary objectives and run the risk of resistance, making sure a sustainable and safe future for their livestock operations. To conclude, buying LRP Insurance policy is a proactive approach for farming manufacturers to attain enduring economic safety and security and secure their source of incomes.

Verdict

In final thought, Livestock Threat Security (LRP) Insurance coverage is Bonuses a useful device for animals producers to alleviate market threats and safeguard their financial investments. It is a smart selection for visit here safeguarding livestock financial investments.